GST Reconciliation in Excel: Save Hours Every Month | Start for FREE!

Monthly GST reconciliation is one of the most repetitive, risk-prone and time-consuming tasks performed by tax teams.

Downloading supplier statements, comparing GSTR‑2A/2B against purchase registers, manually matching invoices and preparing vendor-wise reports — all within tight filing timelines — creates operational stress and compliance exposure.

This Blog explains the problem, demonstrates how a well‑designed Excel tool removes the pain, and summarizes the exact functionality of our GST Reconciliation Tool so you can decide in minutes whether it suits your practice or business.

What GST Professionals Face Every Month

- High manual effort: Reconciliation often involves hundreds or thousands of invoice lines. Manual VLOOKUPs, INDEX/MATCH and pivot‑based checks are slow and error‑prone.

- Timing mismatches: GSTR‑2A is dynamic; GSTR‑2B is a static auto‑drafted ITC statement. Timing differences between supplier filings and your purchase records create apparent mismatches.

- Multiple reconciliation permutations: Professionals need to run different combinations — e.g., GSTR‑2A vs Purchase Register, GSTR‑2B vs Purchase Register, and cross‑matching all three.

- Presentation & communication: Clients and vendors expect clear reports (detailed and concise) and vendor-specific communication to resolve mismatches quickly.

- Regulatory risk: Incorrect or late ITC claims may fall outside statutory time limits for claiming Input Tax Credit under GST law and attract scrutiny.

How Our GST Reconciliation Tool Solves These Problems

Core design principles

- Excel native: Built as an Excel utility so there is no new learning curve for professionals who already rely on Excel.

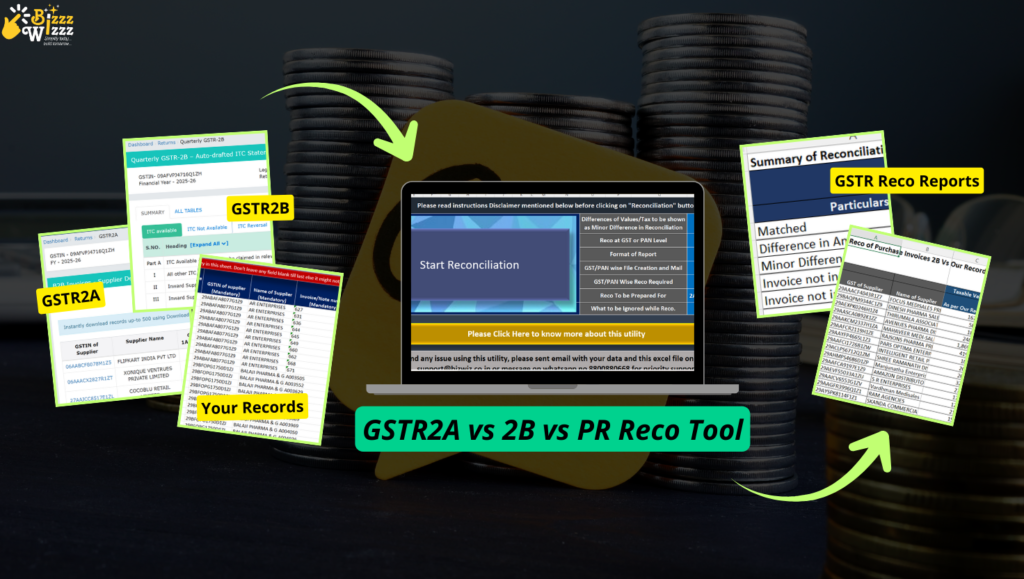

- Paste‑based inputs: Data is pasted from exported GSTR‑2A/2B reports and the purchase register (no complex connectors). This ensures compatibility with any accounting software and any user environment.

- Multi‑combination reconciliation: Run the exact comparison you need — GSTR‑2A vs GSTR‑2B vs Purchase Register — without piecing together separate workbooks.

- Tiered output: Invoice‑wise detail, GSTIN (vendor)‑wise consolidation, and a summary report for management review.

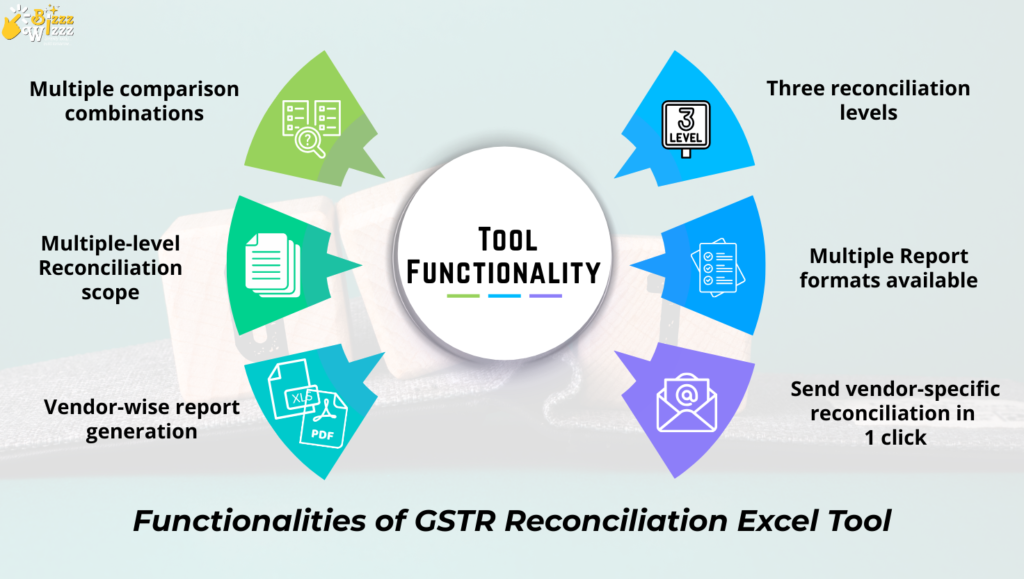

Tool functionality

- Multiple comparison combinations

- Three reconciliation levels

- Multiple Report formats available

- Multiple-level Reconciliation scope

- Value‑adding features:

- Vendor-wise report generation: Create separate vendor reports in Excel and PDF in one click.

- Send to vendor: Email vendor-specific reconciliation using Microsoft Outlook with one click (attachment + message template).

- Intelligent matching: The tool reconciles exact matches and also identifies invoices with small manual errors (GSTIN typos, invoice numbering variants, minor amount differences) using fuzzy matching and configurable tolerance limits — this materially reduces the actual number of exceptions.

- Operational note: Data must be pasted into the tool from the exported GSTR‑2A/2B records and your purchase register. The tool does not directly connect to external systems; this keeps the workflow simple and audit-friendly.

How to Use the Tool — Step‑by‑Step (Takes just 2–3 minutes to start)

- Export/paste GSTR‑2A and/or GSTR‑2B (period under review) into the designated sheet.

- Export/paste your Purchase Register into the designated sheet.

- Select the comparison mode (e.g., GSTR‑2B vs Purchase Register).

- Configure matching tolerances (if required) and run reconciliation.

- Review invoice‑wise results, vendor summaries and the consolidated report.

- Generate vendor‑wise Excel/PDF reports or send via Outlook in one click.

Business Benefits — Quantifiable Outcomes

| Pain area | Before | After (using tool) |

| Time per month | Several hours to days | Minutes to an hour |

| Manual errors | High (formula errors, missed matches) | Low (automated matching + fuzzy tolerance) |

| Client turnaround | Slow | Faster with professional vendor reports |

| Compliance risk | Higher (late detection) | Lower (timely detection & communication) |

Replace Monthly Pain with a Repeatable Process

For GST teams, the monthly reconciliation is not a one‑off task — it is a recurring operational vulnerability. A purpose‑built Excel reconciliation tool removes manual steps, reduces exceptions via intelligent matching, and converts a risk activity into a repeatable, auditable process.

Try the free 7‑day trial (complete product copy) and assess the time and compliance gains on your own client data. If you need any additional product clarifications or want the sample error cases uploaded into the tool, share them and we will confirm how the tool classifies and resolves each exception.

- Free 7‑day trial: The trial is a full copy of the paid tool (all features enabled). You will see exactly what you get before you pay.

- How to obtain: Download the free 7 days trial from: https://www.bizwiz.co.in/utility-detail/32

- Check Full Tool here: https://www.bizwiz.co.in/utility-detail/34

- Need help? Start a WhatsApp chat for instant support and onboarding guidance — our team can help paste your first dataset and run the first reconciliation.

Key Questions

Q: Is reconciling GSTR‑2A/2B with books necessary?

A: Yes. Reconciliation is a compliance best practice to ensure Input Tax Credit claimed in returns is supported by supplier filings and invoices; it helps detect errors, missed credits and potential notices.

Q: What is the difference between GSTR‑2A and GSTR‑2B?

A: GSTR‑2A is a dynamic statement that reflects supplier filings as and when they are uploaded. GSTR‑2B is a static, month‑wise auto‑drafted ITC statement generated by the system for easier ITC reconciliation.

Q: How soon can reconciliation be completed with automation?

A: With a purpose‑built Excel tool it is possible to complete comprehensive reconciliation (including reports) in minutes rather than hours — depending on dataset size and system performance.

Q: Can a reconciliation tool handle small manual errors (typos, round‑offs)?

A: Yes — high‑quality tools use intelligent matching (fuzzy logic and tolerance thresholds) to identify and reconcile invoices that have minor manual errors, significantly reducing true mismatches.

Great information